How to Calculate Your Income Tax Return 2024

Income Tax Return 2024 is an online tool that allows you to see how much your tax refund will be. You can use this tool at many different sites, including those offered by tax prep companies and financial websites.

Each year, the IRS adjusts more than 60 tax provisions for inflation to prevent what’s known as “bracket creep.” The adjustments are effective for tax years that begin in January.

Tax brackets

The US tax system is complex, with many different rates and brackets. It’s important to have a basic understanding of these different rates to avoid surprises when filing your taxes. Tax brackets are thresholds that divide your income into categories, each with a corresponding rate. They are periodically adjusted for inflation. The IRS has several online tools that can help you calculate your tax bracket. The most important factor is your taxable income, which includes wages and tips, investments, property rental, social security benefits and unemployment compensation. You can also include 401(k) withdrawals, capital gains and dividends.

The number of tax brackets varies by state. Some states have as few as three, while others have up to 12 tax brackets. Generally, the more you earn, the higher your tax bracket will be. Moreover, you must consider any deductions and credits that apply to your situation. This can significantly reduce your tax bill.

To determine your federal tax bracket for the 2024 tax year, you must know your filing status and taxable income. The calculator will ask for these details in the first step. It will then display the federal tax rates that apply to you, including your marginal tax rate. The calculation will then show you the amount you owe in federal taxes, along with the standard deduction and any other applicable tax deductions.

If you want to reduce your taxes, you can maximize the amount of deductions you claim and minimize the amount of income you report. You can also defer certain types of income, such as annual bonuses or sales commissions, to the following year, which will lower your taxable income for the current year. In addition, you can try to shift income into lower tax brackets by donating appreciated securities or contributing to tax-deferred accounts such as 401(k)s and IRAs.

The calculator will also let you know the amount of tax you owe in each state, based on its tax brackets and tax rates. The calculator will not take into account other taxes, such as local or school tax rates, which you may be required to pay.

Marginal tax rate

When calculating your federal income tax bill or refund, you need to know your marginal tax rate. This is the highest tax rate that you pay on each additional dollar of your taxable income. Your marginal tax rate is based on your tax bracket, which is set by the IRS each year to reflect inflation adjustments. However, the marginal tax rate is not the same as your effective tax rate.

The effective tax rate is the percentage of your taxable income that you pay in taxes, calculated after taking into account all deductions and credits. Your taxable income is your earned and investment income plus adjustments and deductions. The simplest way to calculate your effective tax rate is by dividing the total amount of taxes you owe by your taxable income.

Whether you’re paying taxes or getting a refund, you can expect your IRS filing to take up to three weeks to process. This is a huge improvement over 2022, when the agency was facing backlogs and a lack of resources. The IRS has also announced it’s adding new technology to help speed up processing times.

In addition to the standard deduction, Americans can benefit from a variety of tax credits. Tax credits are dollar-for-dollar reductions in your tax bill, and can save you more than deductions. For example, if you have a $2,000 tax bill, you could save $500 in taxes by qualifying for a tax credit.

The IRS is also raising limits for certain tax-advantaged accounts. For example, the maximum limit for flexible spending accounts will increase to $3,200 from $3,050 in 2024. These accounts allow employees to put pre-tax money into accounts that can be used for short-term health care expenses.

Those with significant changes in their lives this year should consider hiring a professional to ensure they are meeting tax requirements and claiming all the available benefits. These changes might include having a baby, buying or selling a home, or making major career moves. It is also important to understand how different federal and state income tax rules will affect your tax return.

Deductions

Deductions reduce your taxable income by lowering the amount of taxes you owe. You can choose to take the standard deduction or itemize your deductions on your tax return. The standard deduction is a blanket amount that you can subtract from your adjusted gross income (AGI), while itemized deductions are individual expenses such as property taxes, unreimbursed medical costs, or business mileage. If you itemize, you must keep records to prove your claims.

If you’re filing a return for the first time or have significant changes in your circumstances, consider hiring a professional tax preparation service to file for you. These professionals can help you make sure you are filing correctly and claiming all of the deductions you deserve. They also can advise you on the latest tax law changes that may impact your return.

The IRS has introduced new technology that should significantly improve processing times this year. It has also reached its goal of reducing call wait times to less than three minutes during the peak filing season. In addition, the agency has implemented several improvements to prevent identity theft and fraud.

Generally, you can use the online calculator to estimate your tax bill or refund based on your earnings, age and deductions. You can also view common tax credits, such as the child tax credit and earned income tax credit. You can also enter your other income sources, such as interest, dividends, rent, unemployment compensation, and investment earnings. If you’re married, you can enter your spouse’s income to calculate the joint return.

You can also estimate the amount of tax withheld from your paycheck, if applicable. If you expect to owe tax, you can use the withholding calculator to determine how much you should be withholding from each paycheck.

For the 2024 tax year, the IRS has updated some of its forms and instructions to reflect changes in the tax law. These changes include a higher standard deduction, a lower marginal tax rate, and more generous tax credits. In addition, the agency has added a new tool to help taxpayers check the status of their refunds. The IRS has also published a list of frequently asked questions to help taxpayers navigate the changes.

Credits

The earned income credit is a refundable tax credit that helps lower your taxes. It is available to individuals or married filers with qualifying children and has different income thresholds. You can claim it on your taxes in addition to other deductions. For the 2024 tax year, the credit is worth up to $7,830 for three or more qualifying children and $632 for one child. This amount is up from $4,213 for one child and $632 for no children in the previous year. The refundable portion of the child tax credit will also increase from $1,600 to $1,700.

Many Americans rely on their tax refunds for household expenses or to pay off debt. The average refund is about $2,948, according to the IRS. Some people even use it to buy a home or invest in their business. It is important to file taxes early, and you may want to consider getting an extension if you are owed money.

A financial advisor can help you find tax credits that you may be eligible for. They can also help you navigate the changing tax landscape. For example, some tax credits that were expanded or increased in 2021 will revert to their previous forms for the 2023 filing season.

Tax credits can significantly reduce your tax liability. But it’s important to understand the rules and limits before claiming them. A financial advisor can help you determine which tax credits are right for you and how much you should claim.

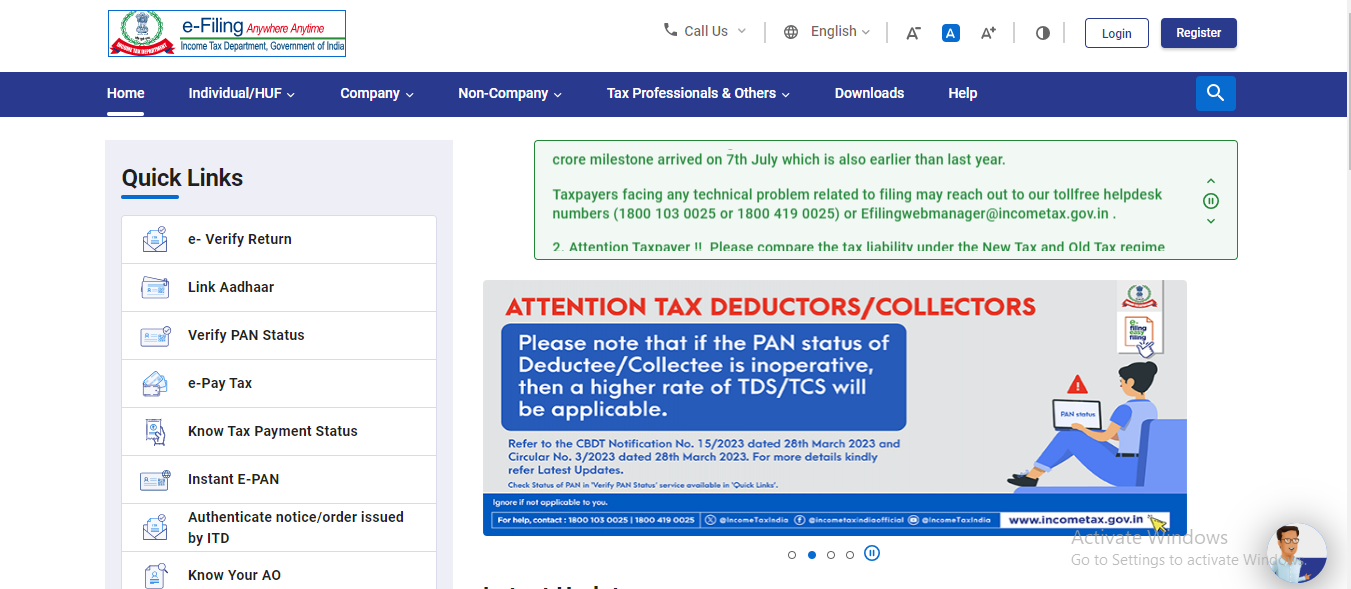

There are some tax credits that you can only get if you are filing an ITR-4. This form is used by individuals whose total income is less than Rs 50 lakh. The return can be filed either electronically or in hard copies. In order to file an ITR-4, you must provide proof of identity and address. You should also include a copy of your PAN card. This information will help the IRS identify taxpayers who are victims of stolen-identity tax fraud.

NerdWallet writers are subject matter experts who use primary, trustworthy sources to inform their work, including peer-reviewed studies, government websites, academic research and interviews with industry experts. They take pride in writing content that is accurate, timely and relevant.

Income Tax efiling Process

The filing of the income tax return (ITR) online, also known as electronically, is the preferred method used by business and individuals to declare their earnings as well as tax payments to the government. This step-by-step guide will assist you in the procedure:

Step 1: Gather Required Documents

Before beginning, make sure that you have all of the required documents at hand:

- PAN (Permanent Account Number)

- Aadhaar Card (linked to PAN in case it is necessary)

- Statements from banks

- Formula 16/16A issued to you by the employer(s) in which you are able to summarize your earnings as well as tax deduction

- Investment documents such as receipts for LIC premiums, PPF contributions, etc.

- Information about other sources of income Sources of income: Like rental or capital gains, interest or other sources.

Step 2: Choose the Right Form

Choose the appropriate ITR tax form that is based on the sources of income

- ITR-1 (Sahaj): For those earning income from salary or one property in the house, and other sources (interest and so on.) and a gross income of in excess of 50 lakh. 50 lakh.

- ITR-2 for individuals or HUFs that do not receive income from gains and profits of professional or business.

- ITR-3 ITR-3 is for people and HUFs earning earnings from gains and profits from their profession or business.

Step 3: Calculate Taxable Income and Tax Liability

Compute your total income, deductions under various sections (like 80C, 80D, etc. ) in order to determine the tax-deductible amount. Calculate the tax obligation, including any the applicable cesses.

Step 4: Register on the Income Tax e-filing Portal

If you haven’t registered already, visit the Income Tax Department’s e-filing website (https://www.incometaxindiaefiling.gov.in/) and register yourself. It will require your PAN to be your user identification.

Step 5: Fill Out the Form Online

Log into your account, then select the applicable ITR form. Make sure you fill in all the information with care, making sure that you are accurate in the income figure as well as deductions claimed. taxes due.

Step 6: Verify and Generate XML

Check the completed form to ensure the correctness of the form. Make sure to save the form. Then, you can create an XML file that will be necessary to upload.

Step 7: Upload the XML File

Sign in to your e-filing account, go to ‘e-File Income Tax Return’, and then upload your XML file.

Step 8: Verify ITR-V (Acknowledgement)

When you upload your file, an ITR-V (Acknowledgement) is created. It is downloaded, signed in blue ink, then forward it back to CPC Bangalore within 120 days after e-filing. You can also use Aadhaar OTP/e Verification to verify your identity immediately.

Step 9: Receive Acknowledgement

When the ITR-V is processed and received Once the ITR-V is processed, after processing, Income Tax Department will send an acknowledgement email to the email address you have registered.

Step 10: Track the Status

It is possible to track the status of the return you filed via the electronic filing website.

Tips:

- Do not file your return before the due date Returns must be filed by the deadline (usually the 31st of July for individual taxpayers) to avoid penalty.

- Maintain records Documents should be kept of all documents that are submitted to the government for at least 6 years.

- Get help from a professional Get in touch with an expert tax consultant for more complicated circumstances or questions.

Following these steps follow these instructions, you’ll be able to prepare your tax returns for income online, and make sure you’re in that you are in compliance with tax laws.

Income Tax About

Tax on income is a direct tax that is imposed by the federal government on income earned by business, individuals and various other entities that fall that fall within its control. It’s a major source of income for government across the globe and serves for public services and infrastructure.

Key Features of Income Tax:

- Different types of income tax The tax on income may be classified into different types depending on what source the income comes from

- Indigent Income Tax Taxes imposed on the income of an individual from a variety of sources like salary and business income rental, capital gains as well as other sources.

- Corporate Income Tax is applicable to income earned by corporations or companies.

- Capital Gains Tax tax is levied on earnings earned from the sale of capital assets, such as bond, stock, or property and so on.

- Dividend distribution tax A tax levied by businesses for dividend distribution to shareholders.

- withholding tax Tax is taken at the source of income such as rental, salary, interest and more. And then, deposited with the federal government.

- Taxation authorities Taxation Authorities: Income tax is collected and administered through regional and national tax authorities. In India the administration of taxation is handled through tax authorities in the Income Tax Department under the Central Board of Direct Taxes (CBDT).

- Taxable income Taxable Income: The amount of income on tax-paying is called taxable income. It is determined after subtracting the allowable expenses, exemptions and deducting the entire earnings.

- Slabs and Tax Rates Rates of tax and slabs differ by state and may be progressive (where more income is subject to higher tax rates) as well as flat (a steady rate for every income level).

- File and Compliance Taxpayers must submit annual tax returns that disclose the income they earn, deductions made and the amount of tax they have paid. Failure to comply could result in penalties as well as penalties from the law.

- Tax planning and deductions Taxpayers typically employ legal techniques to limit the tax burden by using tax-saving strategies and claiming deductions in diverse sections of the tax code, etc.

Importance of Income Tax:

- Revenue Generating Income Tax is the main source of government revenue for the welfare and public service programs construction of infrastructure, defense, and so on.

- Redistribution of wealth The progressive tax system are designed to distribute wealth through charging higher income earners greater rates while also offering the social benefits for those with lower incomes.

- Economic Stability The tax policy of income affect economic behaviour investments, as well as general economic stability.

- Fiscal Policy Tool Use of the tax rate and policy on income to regulate the rate of inflation, to encourage or deter specific economic activity as well as to stimulate expansion.

Knowing the tax implications of income is essential for businesses and both individuals to be sure that they comply with the law obligations as well as improve the financial plans they make. It is a major factor in the development of economic policies and social welfare policies in nations all over the world.

Filing your Return

The filing of your tax return is an important annual task for both businesses and individuals. This is a comprehensive instruction on how you can do it:

1. Determine Your Filing Status

- Individual: Find out if you have to declare yourself as an individual taxpayer according to your income, age or other guidelines that are set by the tax authority.

- Business If you are the owner of your own business, be aware of what type of entity you are (sole proprietorship or corporation, partnership or corporation, etc.) as well as the filing of tax requirements.

2. Gather Necessary Documents

- Personal Information: Gather documents like PAN card, Aadhaar card, bank account details, etc.

- Revenue Documents Take the income-related documentation you can, including Formula 16 (issued by your employer) Bank statement, income statements for interest rent receipts and so on.

- Investment Evidence Take the proof of investments that were that were made in various sections such as 80C,80D and more.

- Other deductions Keep documentation of all expenditures and deductions that you claim like medical expenses and tuition costs and home loan interest etc.

3. Choose the Correct ITR Form

- Pick the correct income tax return (ITR) type according to your source of earnings, residency status as well as other aspects:

- ITR-1 (Sahaj): For people earning a income from a salary, one property, and other sources (excluding the lottery winnings or earnings from racing horses).

- ITR-2 for individuals and HUFs who do not earn from the gains or profits earned by professional or business.

- ITR-3 for individuals as well as HUFs who earn earnings from gains and profits from their profession or business.

4. Compute Taxable Income and Tax Liability

- Determine your overall income by combining the sources of income and subtracting the tax deductions you are entitled to under different provisions of the Income Tax Act.

- Calculate your tax obligation by using tax rates applicable and slabs. Add a surcharge and cess in the event of relevant.

5. File Online

- Register on the Income Tax e-filing Portal: If you haven’t already, register on the official Income Tax e-filing website (https://www.incometaxindiaefiling.gov.in/).

- Fill in the form Sign in to your account, then select the pertinent ITR form, then make sure you fill out the information accurately.

- Upload Documents Supporting the Upload Add the required documents and verify the data supplied.

6. Verify and Submit

- Review Review: Double-check the information on the form to ensure the accuracy and the completeness of information.

- Submit Once you have verified the form you can submit the form electronically. If you submit the form successfully you will receive an acknowledgement number.

7. Verification (ITR-V)

- If you file electronically, you could be required to check the accuracy of your return

- E-verification: Use Aadhaar OTP, Net Banking, Demat Account, etc., for instant verification.

- ITR-V If you are not e-verified you can download the ITR-V file, fill it out, then send it back to CPC Bangalore within 120 days after e-filing.

8. Receive Acknowledgment

- Following successful verification After successful verification, after successful verification, the Income Tax Department will process the return. The IRS will send you an acknowledgement by an email.

9. Monitor Status and Refund

- Check what is happening with your tax return via the online filing portal. If your return is eligible for refund, keep track of the status of your refund and be sure to get that you receive your refund on time.

10. Maintain Records

- Make backup copies of the filed returns and acknowledgement receipts (ITR-V) along with any additional documents that support them for future review and audits.

Important Tips:

- Filing on Time Be sure to complete your return prior to the due date in order to save yourself from penalties and interest.

- Correctness is the Key Make sure you double-check the information given to prevent errors as well as delays when processing.

- Find Professional Assistance Get help from an expert tax consultant for more complex tax matters or require assistance with deductions or exemptions.

When you adhere to these tips by following these steps, you will be able to successfully complete your tax return and satisfy the tax requirements efficiently.

5 Simple Steps to e-file your Income Tax Return

The process of e-filing your tax return (ITR) is an easy procedure if you adhere to these 5 easy steps:

1. Prepare and Gather Documents

Make sure you have all the necessary documents ready before beginning the e-filing process:

- Personal Details: PAN card, Aadhaar card, bank account details, etc.

- income documents Form 16 (issued by employers) and salary slips. bank interest certificates rent income statements and so on.

- Investment Evidence Recipts or evidences of investments that were made in section such as 80C, 80D and 80G.

- Statements from Banks statements that show how much interest was earned, transactions and other information.

- Other deductions Receipts and bills of expenses which are deductible.

2. Register on the Income Tax e-filing Portal

If you haven’t registered already, visit the Income Tax Department’s e-filing website (https://www.incometaxindiaefiling.gov.in/) and create your account using your PAN. In the event that you already have an account, sign into the account with your existing credentials.

3. Select the Right ITR Form

Select the correct ITR type according to your income source as well as other factors:

- ITR-1 (Sahaj): For people who earn a living from the salary of a house, a single property and/or other sources (excluding winners from lottery or racing horses).

- ITR-2 for individuals or HUFs that do not receive income from the gains or profits earned by professional or business.

- ITR-3 for individuals as well as HUFs who earn earnings from gains and profits of their business or profession.

4. Fill Out the Form Online

After logging in, click the ITR that is relevant to you and submit the form online:

- Input personal information including income and earnings details, deductions claimed and tax-related payments.

- Make sure you enter the correct the financial information to prevent mistakes and discrepancies.

5. Verify and Submit

Before you submit the form, check the form filled in for exactness and completeness:

- Check all data and confirm that each field is filled correctly.

- After verification, send the form electronically by clicking the button ‘Submit.

- After submitting successfully after successful submission, you will receive an acknowledgement in the form of a screen as well as an email.

Additional Tips:

- Filing Early it is advised to file your tax return well prior to the due date in order so that you don’t have to rush last minute and possible technical problems.

- Keep records Keep documents related to completed returns, acknowledgment receipts (ITR-V) and other additional documents in case of future need.

- Request assistance if needed If you’re dealing with complicated source of income or deducts think about consulting tax professionals for help.

Following these easy steps, you will be able to successfully electronically file your tax return and make sure you’re in that you are in compliance with the tax laws.

Best income tax e filing website in India

In India the main and widely-used online tax filing website for income tax has been managed through the Income Tax Department of India. Here are some important details on the official website for e-filing:

Official Income Tax e-filing Website:

- Website: Income Tax Department e-Filing Portal

- Managed By: Central Board of Direct Taxes (CBDT), Government of India

Features and Benefits:

- Friendly Interface for Users The site was designed in order to make it simple and easy to use, which makes taxpaying taxpayers able to use and fill out tax return.

- Secure Transactions This website employs encryption protocols that are secure to protect the taxpayer’s information as well as transactions.

- Complete Services It provides various services that go that go beyond e-filing. These include the tracking of refunds download forms, sending responses to notices and so on.

- Access to forms and resources Taxpayers are able to access different forms, directions, as well as guides for the filing of income tax and complying.

- Mobile-Friendly The site is designed for smartphones that allow taxpayers to fill out tax returns as well as access the services they need while on the move.

Steps to Use the Income Tax e-filing Portal:

- Registration Taxpayers have to sign up on the website by using the PAN (Permanent Account Number). It is a once-off process.

- Forming returns Select the correct ITR form for the sources of your income, complete it out online and then submit it electronically.

- Status and Tracking Following your filing, keep track of how you are doing on your tax return as well as refunds and notifications sent by Tax Department. Income Tax Department.

- Additional Services Look into additional services including connecting Aadhaar and filing response to tax notices or updates personal data, etc.

Considerations:

- Security Access the web site via secure connections. Keep the login credentials private.

- Quick Filing Returns must be filed early enough to avoid interest and penalties on taxes due.

The income tax department’s electronic filing portal is the most recommended option to submit taxes on income for India because of its status as an official entity, the reliability and a wide array of offerings.

How to e-Verify

The e-verification of tax returns (ITR) can be a simple and safe method of authenticating your tax return electronically and without needing to submit physically signed copies (ITR-V) for the Income Tax Department. This is how to verify your tax return:

E-Verification Methods:

1. Aadhaar OTP (One-Time Password) Method:

- A prerequisite Make sure you have your Aadhaar is linked to your PAN. If you are not connected to your PAN, you are able to do this via the Income Tax electronic filing portal.

- Process:

- Log in to the Income Tax e-filing portal (https://www.incometaxindiaefiling.gov.in/) using your credentials.

- Click on the ‘e-File menu, then select “Generate Aadhaar OTP’.

- You’ll receive an OTP to your mobile number that is linked to Aadhaar.

- You must enter the OTP via the portal for e-filing for verification of the authenticity of your tax return.

2. Net Banking Method:

- The prerequisite The bank you use should have been authorized to offer this service. Look up the list of approved banks in the E-filing Portal.

- Process:

- Log into the Income Tax E-filing Portal.

- Select the e-File menu, then select ‘Login with Net Banking’.

- Then you will be directed to the net banking portal.

- Follow the steps on the portal of your bank to verify and accept the request for e-verification.

3. Electronic Verification Code (EVC) Method:

- A prerequisite The ability to generate EVC using a variety of methods available through the e-filing portal (e.g. using a an email address, registered mobile number ID ATM, etc. ).

- Process:

- Login to the Income Tax electronic filing portal.

- Choose the ‘e-Verify Return Select the ‘e-Verify Return’ option.

- Pick the ‘I’ve EVC already’ choice.

- Enter the EVC you received from the registered mobile number of your account or your email address.

- Complete the form to verify your return.

4. Bank Account OTP Method:

- The prerequisite A bank account is required to be verified via the e-filing platform.

- Process:

- Login to the Income Tax electronic filing portal.

- Go to the Profile Settings and click “Prevalidate the Account’. Bank account’.

- Input the details like your bank’s account’s number, IFSC code, etc. And then, verify.

- Once validated, you can go to the option ‘e-Verify Return.

- Select “Generate EVC by using the bank’s OTP’.

- The bank will send you an OTP to your mobile number that is linked to the bank account.

- Input the OTP to finish the verification procedure.

The benefits of electronic verification:

- instant verification Verification takes place immediately without the requirement for physically submitting documents.

- The convenience can be performed anytime, anywhere via internet bank accounts, Aadhaar OTP, or alternative methods.

- Secure Secures your data and security through secure transactions.

Once you have successfully verified your ITR, you’ll get an acknowledgement from the e-filing website and also to your email account that has been registered to verify that you have been verified. Make sure to keep a copy the acknowledgement to keep for documentation. If electronic verification isn’t possible then you can prefer physical verification by sending your signed ITR-V at CPC Bangalore within 120 days after submitting the e-filing.

Check Your Latest Income Tax Refund Status

To find out the current situation of your income tax return in India to check your refund status, follow these steps:

Using the Income Tax e-Filing Portal:

- Login: Visit the Income Tax e-Filing portal at https://www.incometaxindiaefiling.gov.in/ and log in using your credentials (User ID, Password, and Date of Birth/Date of Incorporation).

- Go to “My Account’: After you have logged in, visit My Account. Account page.

- View Refund/Demand Status:

- In the My Account under the tab ‘My Account under ‘My Account’, select ‘View Returns/Forms’.

- Choose the assessment year that you’d like to verify the status of refunds.

- You can click on the acknowledgment code of the return filed in order to determine the status of the refund.

- Check Status of Refund on the following page, you’ll see information about the return that has been that was filed. The status of the refund (whether it was processed, dispatched or with any other issues) will be shown here.

Alternative Methods:

- Direct link Direct Link HTML0: You may also directly go to the page for refund status using this hyperlink: ITR Status

- Mobile App Mobile App: Download the income tax department’s mobile application “Aaykar Setu accessible on Android as well as iOS platforms to track the status of your refund on while on the move.

Refund Status Meanings:

- Return submitted and verified The return you submitted has been verified successfully with The Income Tax Department.

- Refund approved The refund was authorized by the assessing officer.

- Refunds Dispatched Refund was deposited into your bank account via ECS (Electronic Clearing Service) or via a paper check.

- No Demand, No Refund There is no refund required as per department’s calculation.

Contacting Income Tax Department:

If you have any problems or issues with your tax refund, reach the IRS’s helpline at 180018061 or 011 (toll-free) to get assistance. Be sure to have your tax identification number as well as your assessment year information ready in case you need to contact them.

Monitoring your refund status frequently when you file your tax return makes sure that you’re informed of the status of your refund and make the necessary changes if needed.

Income Tax Services Offer

1. Income Tax Return (ITR) Filing:

- The preparation and filing of tax-related income returns for businesses, individuals and various other types of entities.

- Attesting compliance with all current tax laws and rules.

- The handling of different ITR forms that are based on the client’s requirements and sources of income.

2. Tax Planning and Advisory:

- Assisting clients in ways to reduce taxes as well as investments that are eligible to receive tax deductions.

- Financial transactions should be structured to maximize tax efficiency.

- Tax planning for the long-term to reduce obligations and maximise the benefits.

3. Tax Compliance and Audit Support:

- Helping clients comply with tax needs, including making TDS return, GST return as well as other tax compliance requirements.

- Assisting clients in tax audits carried out by the tax authority.

- Giving advice on how to respond to tax-related inquiries and tax notices.

4. Corporate Tax Services:

- Filing and preparation of tax returns for corporations (ITR-6 for corporations ITR-5 for businesses and ITR-5 for firms, etc. ).

- Assistance with tax planning strategies.

- Compliance with Transfer Pricing and Documentation.

5. International Tax Services:

- Advice on cross-border transactions and associated tax impacts.

- Documentation and analysis of the transfer price for multinational corporations.

- Tax treaties compliance and international reporting requirements for foreign entities.

6. Tax Appeals and Litigation:

- Assisting clients with tax appeals in the appellate courts and authorities.

- Dealing with disputes regarding taxes, refunds and penalties.

7. GST (Goods and Services Tax) Services:

- GST registration, filing GST return, and ensuring GST compliance.

- GST advice on classification, valuation as well as input tax credits.

- Participation as part of GST audits as well as assessments.

8. Tax Due Diligence:

- Tax due diligence is conducted for mergers, acquisitions, as well as investment.

- The assessment of tax risk and the liability arising out of transactions.

9. Employee Tax Services:

- Assistance in tax issues for employees like Form 16 distribution, TDS calculation, etc.

- Information on tax saving options to employees, such as HRA, LTA, etc.

10. Estate and Trust Tax Services:

- Recommending estate planning strategies for minimizing inheritance taxes.

- Compliance with tax laws and filings for estates and trusts.

11. Tax Training and Seminars:

- Workshops and seminars are conducted about tax reform and other regulations changes.

- Financial teams receive training regarding tax compliance and implications.

12. Specialized Consulting:

- The company offers niche services, such as indirect tax consultation as well as tax technology solutions and more.

- Individualized advice based on particular industry or client needs.

They are usually provided through tax experts and chartered accountants. They also offer tax attorneys, as well as specialized firms that specialize on tax issues. Every service is designed to guarantee that tax law compliance is met and maximize financial results to clients.

NRI Income Tax e-Filing in India

The filing of the income tax return (ITR) for Indians who are not residents (NRIs) to India requires specific guidelines and steps. This is a complete guide to the procedure for NRIs can file electronically their tax returns for income in India:

Determining Residential Status

- Residential Status Decide your residence situation for the year according to Indian taxes:

- NRI A person who is deemed to be an NRI according to the Income Tax Act if they don’t fulfill the requirements for residency (i.e. staying in India for less than 182 days during a fiscal year).

- Resident but not normally resident (RNOR): NRIs returning to India after extended stays in other countries could be eligible under this category for up to a couple of years.

Types of Income Taxable for NRIs

- Taxable Income In general, NRIs are taxed in India on the income they earned or received from India which includes:

- Salary from the services that are rendered in India.

- House property income located in India.

- Profits from capital gains from the transfer of assets that are located in India.

- Income from interest as well as other. which is derived through Indian sources.

Steps to e-File Income Tax Return as an NRI

- Registration and Preparation:

- Register: Create an account on the Income Tax e-filing portal (https://www.incometaxindiaefiling.gov.in/) using your PAN (if available) or Aadhaar.

- Choose ITR Form You can select the right ITR form that is based on your income sources (ITR-1 ITR-2, ITR-1, etc. ).

- Income Details and Deductions:

- Input your earnings details which include the salary, rental income and interest earnings. Earned from India.

- Define any deductions that may be that are allowed under Sections such as 80C, 80D and others.

- Tax Calculation and Payment:

- Determine your tax obligation using the applicable tax rates for NRIs.

- Make sure you pay any tax that is due with online payment methods.

- Verification and Submission:

- E-Verification You can verify your tax return by using one method offered (Aadhaar OTP, Net Banking, EVC, etc. ).

- Once you have verified your identity, send your return via electronic.

- Acknowledgment:

- Once you have submitted the form, you can take a moment to download the acknowledgement (ITR-V) or get it by email.

Important Considerations for NRIs

- Tax Traits Take into consideration the taxes arising from Double Taxation Avoidance agreements (DTAA) among India as well as your country of residence in order to avoid double taxation.

- Bank Account Information Make sure that the account you use to refund the funds is a NRO/NRE account depending on the circumstances.

- Tax Deductions and Exemptions The NRI can apply for deductions and exemptions comparable as residents in Indian tax law.

- Deadlines Tax Return Due Dates: Make sure you file your tax return prior to the deadline (usually July 31 for individual taxpayers) in order to avoid penalties and charges.

Professional Assistance

To deal with tax issues that are complex or to make sure that they are in the compliance of Indian tax legislation, NRIs often seek assistance with tax advisors or chartered accountants that specialize on NRI taxation.

If they follow these tips and guidelines, NRIs can efficiently file income tax returns online and meet their tax obligations to India.

ITR for Non Resident Indian – Inclusions

- Consultation by phone or mail at your time of convenience

- In the Income Tax Return, filing is required for one year of financial reporting

- An in-depth analysis of Indian Income and Foreign Income

- Comprehensive analysis of the situation to determine whether your income falls under Capital Gain Head

- Tax refunds can be maximized

- Tax Payment Assistance

- E-verification Assistance

Residential Status – Am I Resident Or Non-Resident (NRI) in India….?

In accordance with Indian taxes the status of your residence is defined as “resident” or “non-resident” (NRI) according to the amount of time you reside in the country in a fiscal year, and other factors. “Resident” or “resident” is someone who fulfills the requirements to be considered to be a resident of India in taxation purposes as well as”non-resident ” non-resident” (NRI) is a person that does not satisfy the requirements.

This article will guide you through the most important elements that affect your residence tax status such as the amount of days that you have spent in India as well as your prior residency background. If you are aware of these guidelines it is possible to determine your residency status in a precise manner and meet the tax requirements accordingly.

Let’s begin by looking at the factors that determine the status of your residence in India as well as understanding what the meaning of residential status is.

Contents

- What is Residential Status Meaning in India?

- Resident Status Classifications

- Example to Explain Residential Status in India

- An exception to the second condition in the case of a Resident Indian

- Importance of Residential Status

- How is Income Taxed According to Different Residential Status in India?

- Residential Status of Hindu Undivided Families (HUFs)

- Residential Status of a Company

- Residential Status of Firms, LLPs, AOPs, BOIs, Local Authorities, and Artificial Juridical Persons

- FAQs about the status of a residential property under income tax

What is Residential Status Meaning in India?

Taxability of any individual within his or her country is based on their residential situation during the year. The term “residential status” has no connection with a person’s citizenship status of India and was defined under the Income Tax Act of India. This is only used for tax reasons. Although an individual may be an Indian citizen India however, they could be an outsider. A foreign national could end up being an Indian resident India for a certain year.

Your residential status within India is crucial for determining what tax you will be charged. In the Income Tax Act defines three types of residential statuses:

Resident Status Classifications

This is the way to categorize different residence statuses could be classified The following is how the different residential statuses can be classified

Resident and Ordinarily Resident (ROR):

It is the most popular type of. It is considered to be a resident of India in taxation purposes when you fulfill one of the following requirements:

- Physically present in India for the minimum of 182 days within an fiscal year. (This is called the 182-day rule.)

- The period of your presence was minimum 60 days during the financial year in which you are currently as well as being living in India at least at least 365 days in the preceding four years of financial year. (This is called”the rule of 60 days.)

Resident but Not Ordinarily Resident (RNOR):

The term “residence” refers to one who is close to India. This could be due to things like your citizenship and birthplace or the place of permanent place of residence. But, according to the Income Tax Act, an person is considered to be ordinarily resident when they satisfy one of the following requirements:

- The Indians have spent at least 730 days in India during the seven years prior to the year in which they are.

- They were in India at least for two out of the preceding ten fiscal years prior to the year in which they are currently.

Non-Resident (NRI):

If you aren’t able to fulfill the conditions for becoming a being a resident or a resident ordinarily, i.e., failing to fulfill these requirements of staying in India In the following circumstances:

More than 182 days the year before or

- at least 60 days during the year preceding it and 365 in the preceding 4 years

It will be classified as an individual who is not a resident for that fiscal year.

Example to Explain Residential Status in India:-

Here are some residence status examples

I) The Mr. Bill Gates stayed in India beginning on April 1st, 2017 until 31 July 2017, and then beginning on September 1st, 2017 until the 30th November of 2017. Does he qualify as is an Indian resident in the fiscal year 2017-2018?

Solution: Total number of days is 30, (april) + 31 (may) + 30 (june) + 31 (july) + 30 (sept) + 31 (Oct) + 30 (Nov) + more than 182 .Since the time Mr. Bill Gates stayed in India for more than 182 consecutive days and was a resident Indian during the fiscal year 2017-18.

II) Mr. Bill Gates stayed in India between 01 April 2017 until 31 July 2017, and until

- 01 September 2013 to 30 November 2013

- 01 September 2014 to 30 November 2014

- 01 September 2016 to 31 March 2017

Are they one of the Indian citizen for the fiscal year 2017-2018?

Solution: Bill Gates stayed in India :

In F.Y. 2017-18. Stay Period= the number of days(30+31+30+31) and

Prior Financial Years =

| Prior Financial Years | Period Of Stay | No of Days Stay |

|---|---|---|

| F.Y. 2016-17 | 01 September 2016 to 31 March 2017 | = 30+31+30+31+31+28+31=212 Days |

| F.Y. 2015-16 | No Stay | =0 |

| F.Y. 2014-15 | 01 September 2014 to 30 November 2014 | =30+31+30=91 Days |

| F.Y. 2013-14 | 01 September 2013 to 30 November 2013 | =30+31+30=91 Days |

| TOTAL | 394 Days |

The condition (i) is 122 days (You are staying at least 60 days in the fiscal year)

and

Conditions (ii) is 394 days( The total number of days or more in the 4 years immediately preceding that financial year)

So, he is believed to be a Resident Indian in the fiscal year 2017-18.

However, in certain situations, the 2nd condition previously mentioned (60 days and all 365 days) does not apply.

Exceptions to the Second Condition in the Case of Resident Indian

The 2nd requirement mentioned earlier (60 days and the 365 days) is not applicable in the case of

- A Indian citizen, who has quit India to seek work in another country, or the crew of an Indian ship or

- An Indian citizen or someone who is of Indian descent who wishes to India

In the above cases, only if you reside in India for 182 days or more during the year of financials then you will be considered to be a resident Indian.

Importance of Residential Status

- The status of a resident plays a crucial factor, particularly when tax burden is calculated for a specific year. Residents pay taxes on the total amount of their income. residents are only taxed for income earned outside of India.

- If you are who file taxes for tax purposes in India it is essential to know their residence condition as residents must submit their tax returns to India However, non-residents need not file tax returns if their income exceeds a particular sum.

- Knowing your residential status is crucial for obtaining the Double Tax Avoidance Agreements (DTAA) to those who live in more than one country and are that are subject to double taxation.

How is Income Taxed According to Different Residential Status in India?

| Particulars | Residential Status | ||

|---|---|---|---|

| Resident | NRI Non-Resident |

||

| Ordinarily Resident | Not-Ordinarily Resident | ||

| The income received, or considered to be earned from India | Yes | Yes | Yes |

| The income accrued or considered to accrued in India | Yes | Yes | Yes |

| The income earned from in other countries India | Yes | Yes | Yes |

Important Points

- The income received from in other countries India however, if it is later transferred to India later, doesn’t make it a receipt for income earned from India. The first receipt is crucial to consider;

- An Indian is defined as a person who has Indian Origin is one who was born in Undivided India. This could be him or either one of his parents or any of his grandparents.

The status of a resident person or organization is a crucial factor in the way in which income tax returns are prepared and the taxes they must pay. The tax obligations and tax filing obligations are dependent on whether an entity is considered to be a resident or non-resident of India.

Making Income Tax Returns for the fiscal year 2023-24 (AY 2024-25) has begun. File early and claim your refunds faster, https://tax2win.in/ca-assisted

For NRI, file your taxes here:-https://tax2win.in/nri-tax-filing

Residential Status of Hindu Undivided Families (HUFs)

- Resident HUF A HUF is considered to be resident in India when the management and control of it is primarily or wholly within India. It is also the case if people who make up the HUF are in charge of it from India. Otherwise, it is a non-resident HUF.

- Resident and Ordinarily Resident: A HUF is regarded as a resident. It is also deemed to be resident when its Karta (manager) meets the following requirements:

- The Karta is a resident of India for at most 2 out of 10 years.

- The Karta is in India for 730 days or longer in the past 7 years.

- Resident, but not ordinarily resident: When the HUF’s Karta is not in line with these criteria, then the HUF is categorized as resident, but is not normally resident.

Residential Status of a Company

- Resident Company: A business is considered to be to be a resident of India in the following circumstances:

- It’s an Indian firm, also known as

- Its point of effectiveness management (POEM) during the preceding year is in India.

- The Place of Effective management (POEM): POEM is the place that is where the key commercial and management company decisions are taken, like the strategic plan and policies.

Residential Status of Firms, LLPs, AOPs, BOIs, Local Authorities, and Artificial Juridical Persons

- Resident They are classified as residents if the control and management of them is mostly performed by a person based in India.

- Non-Resident When direction and control is exercised mostly in a foreign country India an entity is not considered to be a resident.

Conclusion:

Saying in Income Tax:

“An Indian Citizen may not be a resident Indian, but A Foreign Citizen may be a resident Indian. “

A lack of understanding about the correct residency status causes a lot of confusion regarding tax obligations in India.

If you require assistance to determine your residency status or determining your tax status, please contact our tax specialists.

ITR filing for FY 2023-24 is now open and the filing of your ITR early can speed up the processing of the tax refund process and guarantee an accurate and timely filing. This will help you avoid fines and notifications. Complete NRI ITR Forming correctly with Tax2win’s Tax Experts.

FAQs on Residential Status under Income Tax

Q: What’s the meaning of “deemed resident?

A Indian citizen who earns more than 15 lakh (as in 2024) through Indian sources is considered to be a”deemed resident” if they’re not required to pay tax in another country because of their residency, domicile, or any other reason.

Q- What is the condition to be considered a Non-Resident Indian?

In order to be classified as a Non-Resident Indian (NRI) An person must meet all the criteria for being citizen of India. As per the Income Tax Act, an person is considered to be an Indian resident for India for the duration of a calendar year, if they

- Are you in India for an amount of more than 182 days within that calendar year.

- Are they in India for 60 or more days during the calendar year, and during more than 365 days within the preceding four years.

Q- What are the conditions for an individual to be considered a Resident ordinarily resident (ROR)?

A person is said to be Resident and ordinarily resident (ROR) within India when they satisfy all of the following requirements:

- Residence in India It is a requirement that they were residents of India for at minimum 2 out of 10 years prior to the financial year that is relevant.

- Physical Presence: They’ve been in India for at minimum 730 days over the seven years preceding the fiscal year.

Q- What are the two basic conditions to be fulfilled to become a resident in India?

In order to become a resident of India to tax reasons the individual must meet one of these two conditions fundamental to becoming a resident:

- Physical Presence: Be in India for 180 days or more during the preceding year.

- Historic Physical Presence: in India for the duration of 365 or more days in the preceding 4 years of the relevant year as well as for at least 60 days in the year of financial concern.

There are some exceptions to these regulations, especially in the case of Indian citizens who leave India to work or for crewmember aboard an Indian vessel, as well as for those who are of Indian from India who visit India.

Q- What is my Residential Status if I live in India?

In section 6(1) of the Income Tax Act, a individual is considered to be a resident of India when they satisfy one or both of the following requirements the following: they are in India for more than 182 days during the fiscal year or they are in India for 60 or more days during an fiscal year. They also stay in India for at least 365 days in the four preceding years of this year. This qualifies them as a regular citizen for tax purposes.

Q- What is the residential status of NRI?

According to RBI the RBI, a person is classified as an NRI If they’ve not resided in India for longer than 182 days in the financial year preceding.

Benefits of E-Filing Your ITR

Electronic filing (electronic submission) of income Tax Reports (ITR) provides a number of advantages over papers for filing. There are a few advantages:

- Efficiency E-filing may be completed from any location with Internet access anytime prior to the deadline, thus not having to go to Tax offices or wait in line.

- Speed Processing of returns that are electronically filed is usually more efficient than paper returns. Returns, in the event that they are applicable, can be processed faster.

- Accuracy Amount of making mistakes are lessened since e-filing programs typically come with built-in validations, and even provides prompts for correcting mistakes.

- Tracking and Confirmation Tracking and Confirmation: You will receive an acknowledgement by the Income Tax Department upon successful online filing. This confirms that your tax return has been acknowledged.

- Accessibility of records Returns filed electronically are kept online in your account. This makes it simple to access and pull up past returns as required.

- Integration to Financial Systems: E-filing lets you integrate with other financial systems, easing the process of submitting the income of various sources.

- online calculators and tools A number of online tax filing platforms have tax calculators, guides to help and FAQs to help taxpayers calculate the tax liabilities they have to pay.

- Security E-filing platforms use strict security measures to safeguard the information of taxpayers, typically using encryption as well as secure login methods.

- Environmentally Friendly Electronic filing cuts down on paper consumption and contributes positively in environmental conservation efforts.

- Legal Recognition E-filing has been legally acknowledged by tax authorities. It is compulsory for certain types of taxpayers. It ensures that tax law compliance is met.

Overall, electronic filing offers speed as well as accuracy and ease of use which makes it the most preferred method of the filing of Income Tax Returns by numerous taxpayers.

Claim Tax Refund

If you’ve earned more than the income tax rate and you qualify for tax refunds

Avoid Late Filing Fee

In the event of a delay in filing your ITR, it can result in you being charged an amount of 5,000 INR

Obtaining Visa

Foreign consulates could require you to provide your tax returns to prove income for the purpose of obtaining a Visa

Easy Loan Approval

The tax return for income serves as a crucial document to the approval of loans.

FAQ’s on ITR

The e-filing of income tax returns is the method of the filing of income tax online. In accordance with the Income tax department, tax returns for income may be submitted using online exclusively. But, super senior people who file ITR by using Formula 1 or Form 4 are permitted to file using the paper or offline mode.

Tax-related returns that are filed electronically is easy and swiftly from the comfort at home or in the office within 4 minutes or less with Tax2win. It is also possible to go to Tax2win’s Income Tax E-filing Portal. Both processes can be learned on this page..

Each individual, not including the NRI is required to file the Income tax return when your gross total income is greater than the exemption limit for basic exemption. In the old tax system, the minimum exemption amount was 2.5 lakh. In the current tax law, the minimum exemption limit is 3 lakhs to those filing an the income tax return. Senior citizens (individuals of 60 or more but not exceeding 80 years old) and super seniors (individuals who are aged 80 and above) have to submit an ITR when their total gross income is greater than 3 lakhs and Rs. 3 lakhs or the amount of Rs. 5 lakhs during a fiscal year.

ITR Filing is crucial in such cases as well as when the earnings are less than the exemption limit under these conditions:

- Amount or total in excess of Rs.1 crore on one or more current accounts held through a cooperative bank.

- Have incurred an overall expense in excess of Rs.2 lakhs for you or for any other individual travelling to another nation.

- Amount of total incurred expenses more than Rs.1 lakh for payment of electric charge.

- The turnover of sales for an enterprise is greater than Rs 60 lakh in a year.

- Professional gross earnings exceed 10% in the fiscal year.

- The total amount of TDS or TCS is greater than Rs. 25,000 in the fiscal year. This is a limit of the amount of Rs. 50000 for senior citizens.

- The total amount that can be deposited into the savings or other accounts amounts to at least Rs 50 lakh in the course of the fiscal year.

In India the taxpaying public has a number of choices for filing an income tax return (ITR). Taxpayers can file their ITR via the income tax efiling login portal (https://www.incometax.gov.in/iec/foportal/) where taxpayers can file their ITR electronically.

The ITR can be filed using the Tax2win the e-filing login within less than four minutes. Tax2Win’s easy-to-use interface and knowledgeable support will help you file the ITR effortlessly and speedily. The deadline for filing the ITR in FY 2023-24 (AY 2024-25) will be July 31, 2024.

If a person misses the deadline for filing the income tax return (ITR) They may nevertheless file a late return. This tax return must be filed before the 31st of December of the assessment year in question (unless extended by the federal government). In FY 2022-23, it is possible to file a tax return belated by the end of December 2023.

But, it is important to note that the belated tax return must be made with the pay of late fees under 234F. This is subject to certain terms and conditions.

Online filing of income tax is simple that can be completed by doing it at home with Tax2win.

- Step 1. Access the Tax2Win site. There, you can click the button ” File ITR Now.”

- Step 2. Select the source of your income and then click continue.

- Step 3. If you’re an employee you can fill out the Form 16 you have on file. If you don’t possess a Form 16, then you’re free to leave out the step and continue.

- Step 4. Input the year of your financial, PAN & Aadhaar number as well as other essential information like your employment details, Deductions(If Any), and bank account details.

- Step 5. Following the disclosure of all required details. Check your tax return and click on the “File My ITR” button.

Additionally, you can follow the guidance of our experienced CAs who can complete your tax filing. Tax2win eCA is focused on filing precise tax returns, maximizing deductions and obtaining highest tax refunds.

In addition there is the Taxpayer Tax E-filing Portal allows you to easily fill out the return on the internet.

The process to file return electronically using form 16 is as follows:

- Step 1. Click “File It Yourself” and choose”File ITR Now ” File ITR Now” option on tax2win.in and then upload you form 16.

- Step 2. When you upload the Form 16, Tax2win software will automatically fill in the Formula 16 details.

- Step 3. Check your tax calculation immediately and make any necessary changes.

- Step 4. Hit on the “FILE MY RETURN” button then you’re completed!

It’s possible to electronically file the Income Tax Return in the absence of Form 16. Salary slips will also include specifics of deductions that can be utilized even if you do not have Form 16 is not available. Form 26AS and AAIS/TIS are the mandatory forms required to submit Income Tax Returns.

If a tax payer fails to submit their income Tax Report (ITR) within the deadline and is found to be in default, the taxpayer may be subject to pay interest and penalties. For non-filing, or submitting late on ITR in India can be summed up as follows:

- Late filing fee: If taxpayer is unable to submit their ITR before the deadline and is found to be in default, they could be required to have to pay a late filing charge which can range from the amount of Rs. 10,000, subject to the time frame for filing. Late filing fees for late ITR, i.e., ITR submitted late however before the 31st day of the year for which it was assessed the fee is. 5,000. In the case of returns that are filed post December 31 due to late filing, the cost increases by the amount of Rs. 10,000.

- The interest on tax liabilities In the event that a taxpayer owes unpaid tax liabilities due, the tax payer will have to pay interest on the balance due on the date of filing up to the day of the payment. Current interest rates are one percent per month. It is which is calculated starting from the due date for filing to the day when the tax bill is due.

- The loss of benefits that are certain When a taxpayer file late returns and is not timely, they could lose some benefits like the ability to carry forward losses and so on. If they fail to submit an ITR even once and file it late, they won’t be eligible to get TDS refunds, should they be any.

- Prosecution: If there is the willful inability to submit an ITR tax return, the taxpayer could be investigated in accordance with Section 276CC under the Income Tax Act, which may result in imprisonment or fines.

After you have completed the e-filing of your income tax return After that, you need to:

- Inbox to find the email address provided. The email will notify you of your successful filing of your income tax return and ITR-V (Acknowledgement) in the email.

- In the event of a revised notification, an amended ITR will only be filed when your initial ITR has been verified.

- Make sure you check all the figures within your filled ITR form or ITR-V to ensure that there are no any errors, omissions, or mistakes.

- Check the tax return for income within 30 days from filing because the Income Tax Return can be completed only after ITR is confirmed. If you do not check the returns, they is not considered to be submitted or handled through the Department. The Department will not pay the tax deduction for income (if you have one) or other tax refunds. Additionally, you’ll have make a fresh tax return at the beginning of. Find out the full details on this page.

- If you received a tax refund from your tax refund, then you’ll get the refund on your bank account within the next couple of days. It is best to keep monitoring your refund’s status to ensure that you receive all crucial announcements by the tax department. It is possible to keep track of your status of your refund by clicking here..

Notification: Verifying your Income Tax Return is an essential part. It is important to verify your ITR. Income Tax Department will not take action on your income Tax return until it has been confirmed . The deadline to verify Filed income tax returns are 30 calendar days. Prior to this, the time period was set at 120 days. This rule change is in effect to tax returns made on or on or after the 1st of August, 2022. If you did not confirm the tax return you filed the tax return will be deemed “Invalid,” i.e. Null and null. This means that there is the Income Tax Return was not filed. ever been filed.